52+ can i deduct mortgage interest on a rental property

Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. Web Deducting interest on rental property As a rule of thumb a rental property owner can deduct interest payments made to acquire or improve a rental property.

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

If the home equity loan was for 300000 the.

. Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. In the year you.

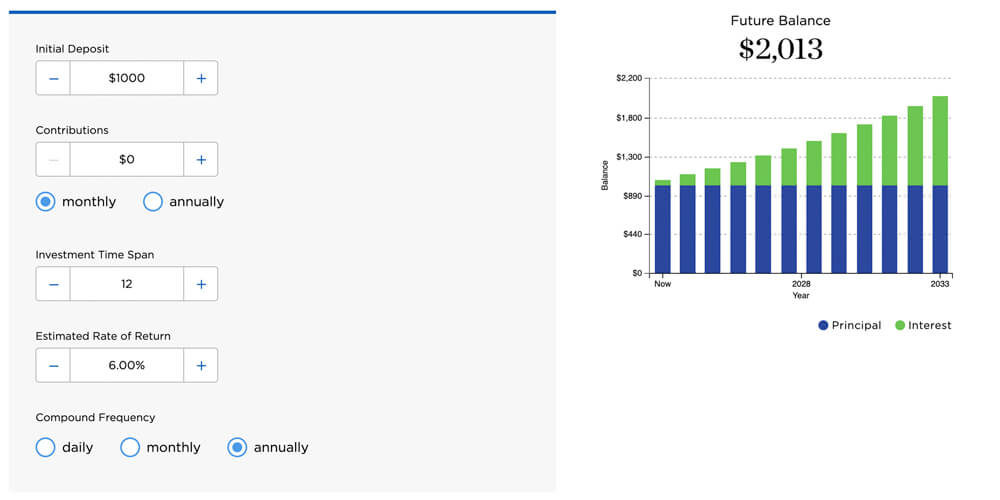

If you receive rental income for the use of a dwelling unit such as a house or an apartment you may. Web Topic No. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 415 Renting Residential and Vacation Property. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income. Web Should that owner have a rental income of 36000 taking a 16000 deduction for the mortgage interest reduces their taxable rental income to 20000a. Web If you paid 5000 in mortgage interest on your San Francisco home you can deduct 2500 on your Schedule A for your personal use and the other 2500 on.

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Web Up to 25 cash back Because the total amount of both loans does not exceed 750000 all of the interest paid on the loans is deductible. Web June 4 2019 1135 PM.

For example if you. Web If you rent your entire property as an Airbnb you can only deduct mortgage interest based on how often the property is rented out. You should have entered the.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000. Web Signed in 2017 the Tax Cuts and Jobs Act TCJA changed individual income tax by lowering the mortgage deduction limit and putting a limit on how much. Homeowners who bought houses before December 16.

Instead these expenses are added to your basis in the.

Vacation Home Rentals And The Tcja Journal Of Accountancy

Gak Group Hyderabad

How To Become Financially Independent In 2023

Mortgage Interest Deduction Faqs Jeremy Kisner

Qyrb1a6qxxdksm

Rocky Point Times July 2022 By Rocky Point Services Issuu

Is Your Mortgage Considered An Expense For Rental Property

Renting My House While Living Abroad Us And Expat Taxes

Calameo Wallstreetjournal 20160113 The Wall Street Journal

Calameo Ombc Case Water Evidence

Can You Claim Rental Mortgage Interest As An Itemized Deduction Budgeting Money The Nest

52 Residential Property In Dehradun Residential Apartments Flats Houses For Sale In City Hospital Dehradun Gpo Dehradun Justdial Real Estate

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

Tax Tips For Photographers To Maximize Your Take Home The Photo Argus

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

Is Your Mortgage Considered An Expense For Rental Property

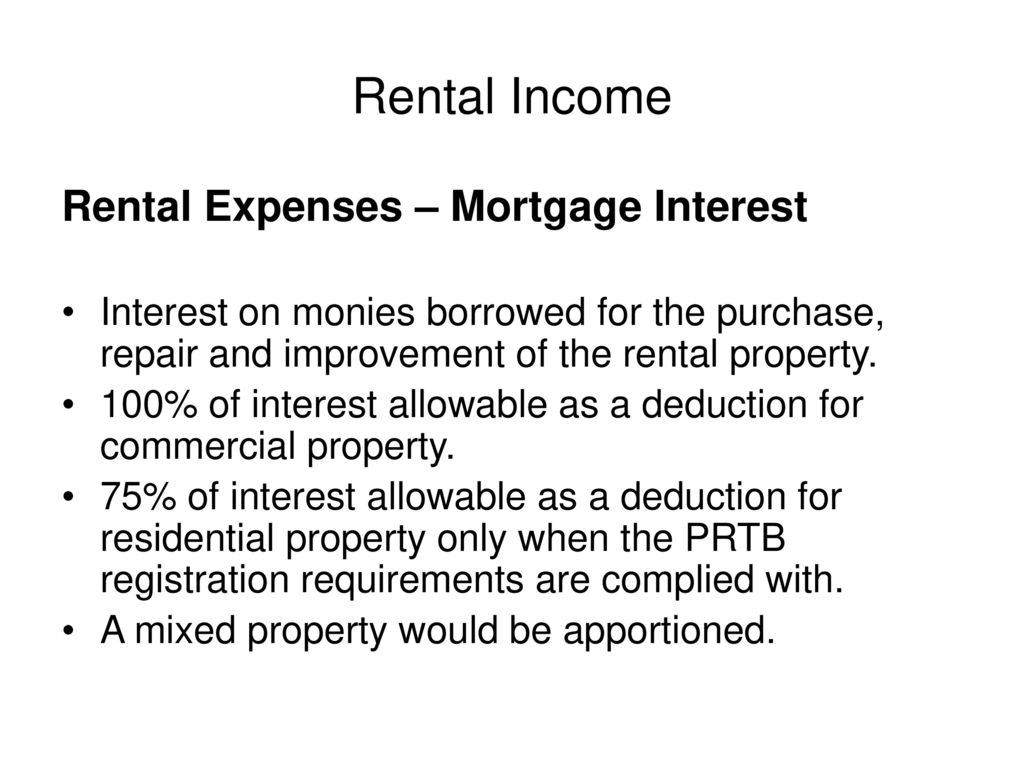

Rental Income Rental Income Irish Rental Income Is Taxed Under Case V Ppt Download